Commercial Lease Calculator

| Year | Base Rent | Adjusted Base Rent | Increase Percent | Bump Amount | Taxes | CAM | Insurance | Utilities | Rent per SF |

|---|---|---|---|---|---|---|---|---|---|

| 1 | $105,000.00 | $105,000.00 | 0.000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $30.00 |

| 2 | $105,000.00 | $105,000.00 | 0.000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $30.00 |

| 3 | $105,000.00 | $105,000.00 | 0.000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $30.00 |

| 4 | $105,000.00 | $105,000.00 | 0.000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $30.00 |

| 5 | $105,000.00 | $105,000.00 | 0.000 | $0.00 | $0.00 | $0.00 | $0.00 | $0.00 | $30.00 |

Understanding Commercial Lease Expenses: Utilize a Commercial Lease Calculator

Commercial leasing is a delicate dance of risks between owners and tenants. Each party makes a move to tip the scales in their favor, while the other counters to regain their balance.

This back-and-forth leads to numerous offer revisions, each requiring careful calculations to assess the financial obligations of the potential contract. In commercial leasing, this process can often stretch over months, and sometimes even years.

When businesses need to move quickly on their commercial leases, this can become a challenge. In such cases, having a commercial lease calculator to quickly analyze your business rent is essential.

Using the Commercial Lease Calculator

New AI Commercial Lease Calculation Generator. Here's how the new AI assistant works:

- Look for the "Generate" section at the top.

- Tell it about your lease like you're chatting with a colleague. Something like: "I'm looking at a 5-year lease for a 2,000 sq ft office space at $25/sq ft with 3% annual increases and 2 months of free rent at the start." Take a look at the available form fields to see what expenses you can tell the AI about. It includes taxes, CAM, insurance, utilities and commissions.

- The AI will fill out those form fields for you.

- Double-check the numbers. The AI's smart, but you're smarter. Make any tweaks you need.

Manual Inputs:

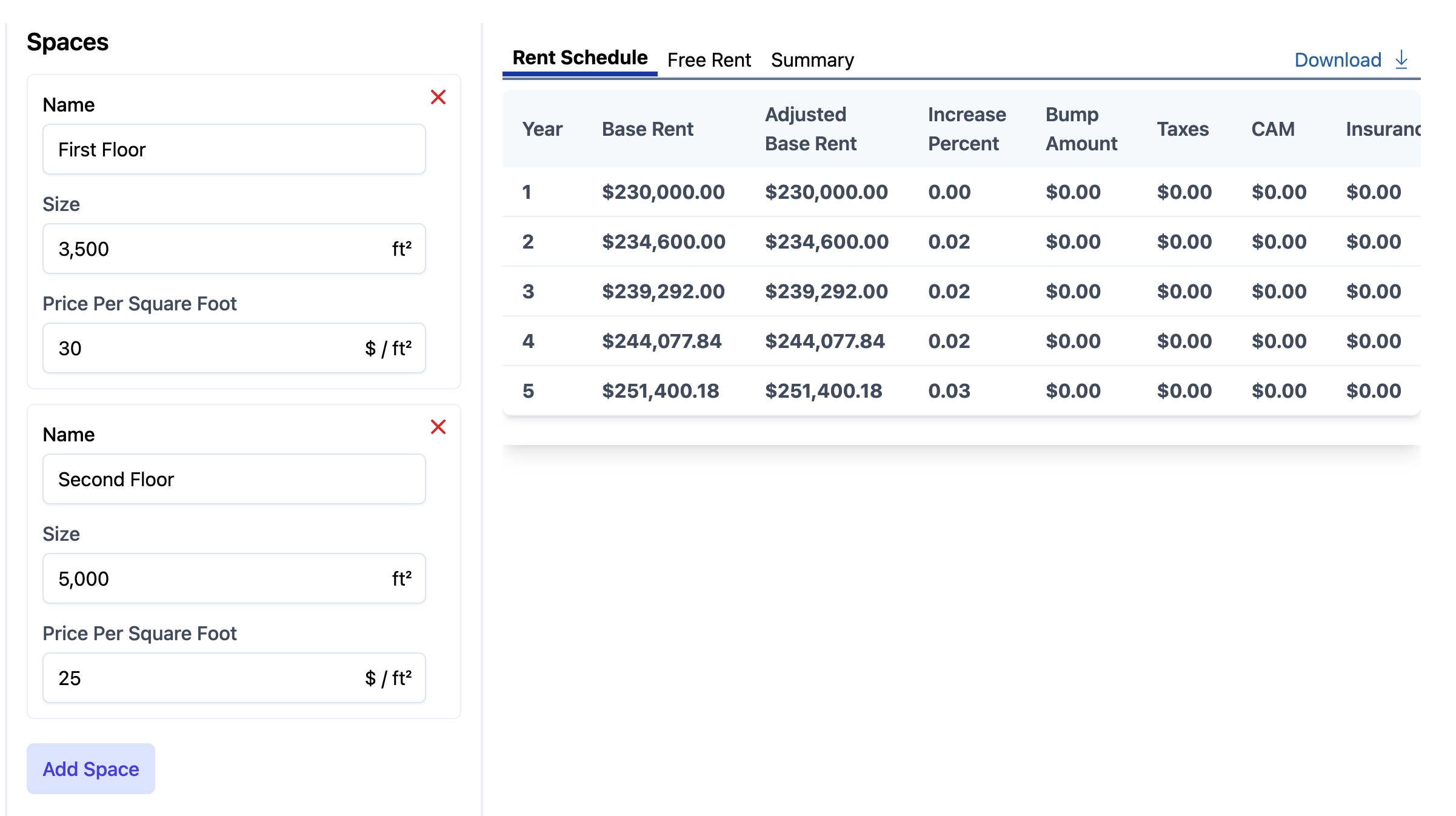

Spaces

Enter one or multiple spaces. Each space can have a different price per square foot. For example:

- First Floor - 3,500 SF - $30 / SF.

- Second Floor - 5,000 SF - $25 / SF.

Term

Enter the length of the lease.Increases

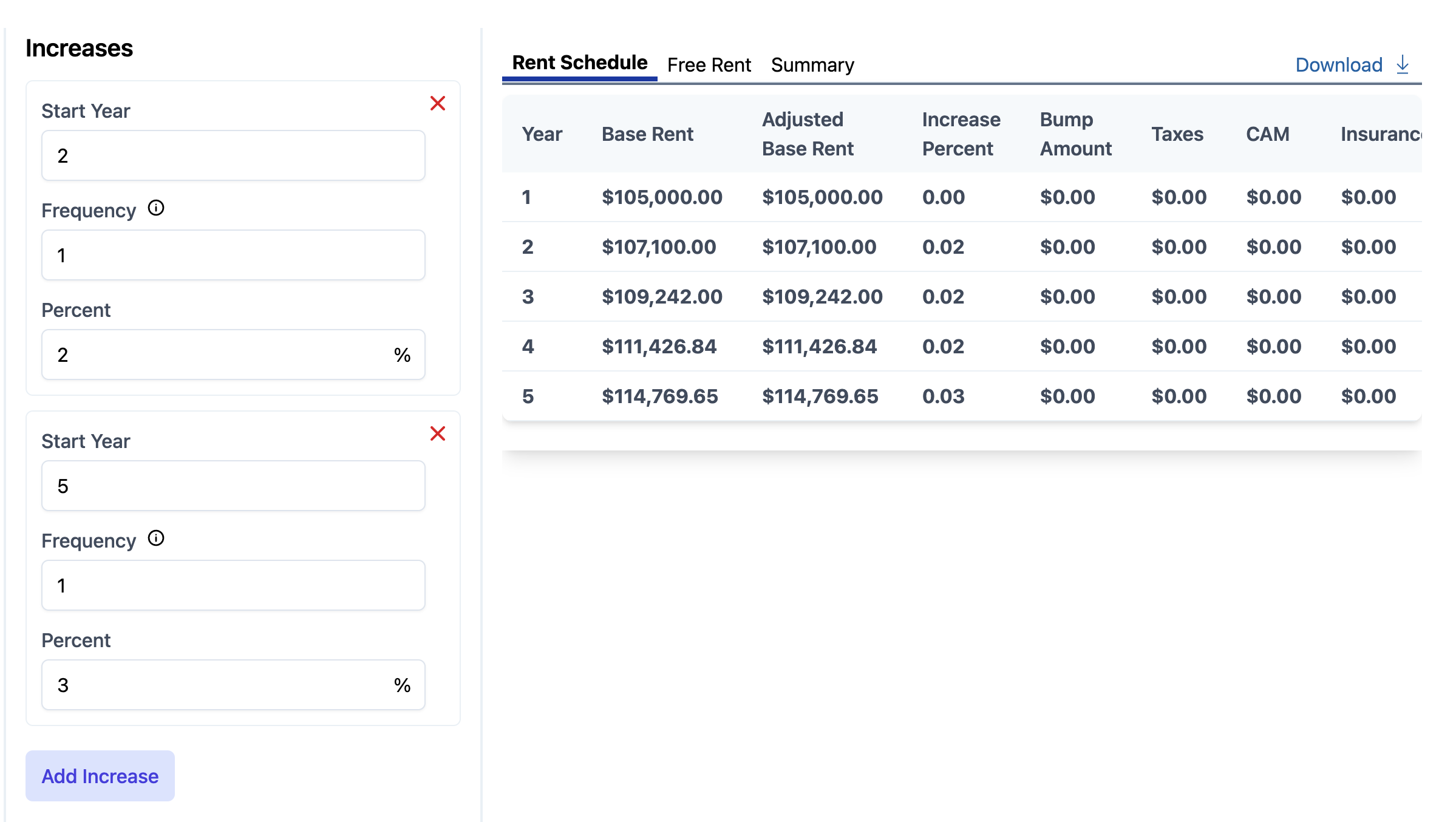

The rate at which the base rent grows. Input increase start year, the frequency it goes up in years, and the percentage it increases by. For example:

- Start year 6 - Frequency 5 (Once every 5 years) - 10% increase

You can also do this:

- Start year 2 - Frequency 1 - Percent 2%

- Starting Year 2 - Once a Year - Increase is 2%

- Start year 5 - Frequency 1 - Percent 3%

- Starting Year 5 - Once a Year - Increase is 3%

- Starting Year 5 - Once a Year - Increase is 3%

Each addition will cancel out the previous input, if not the input will continue the whole lease term as set. With this, you can calculate your commercial lease increases over the term.

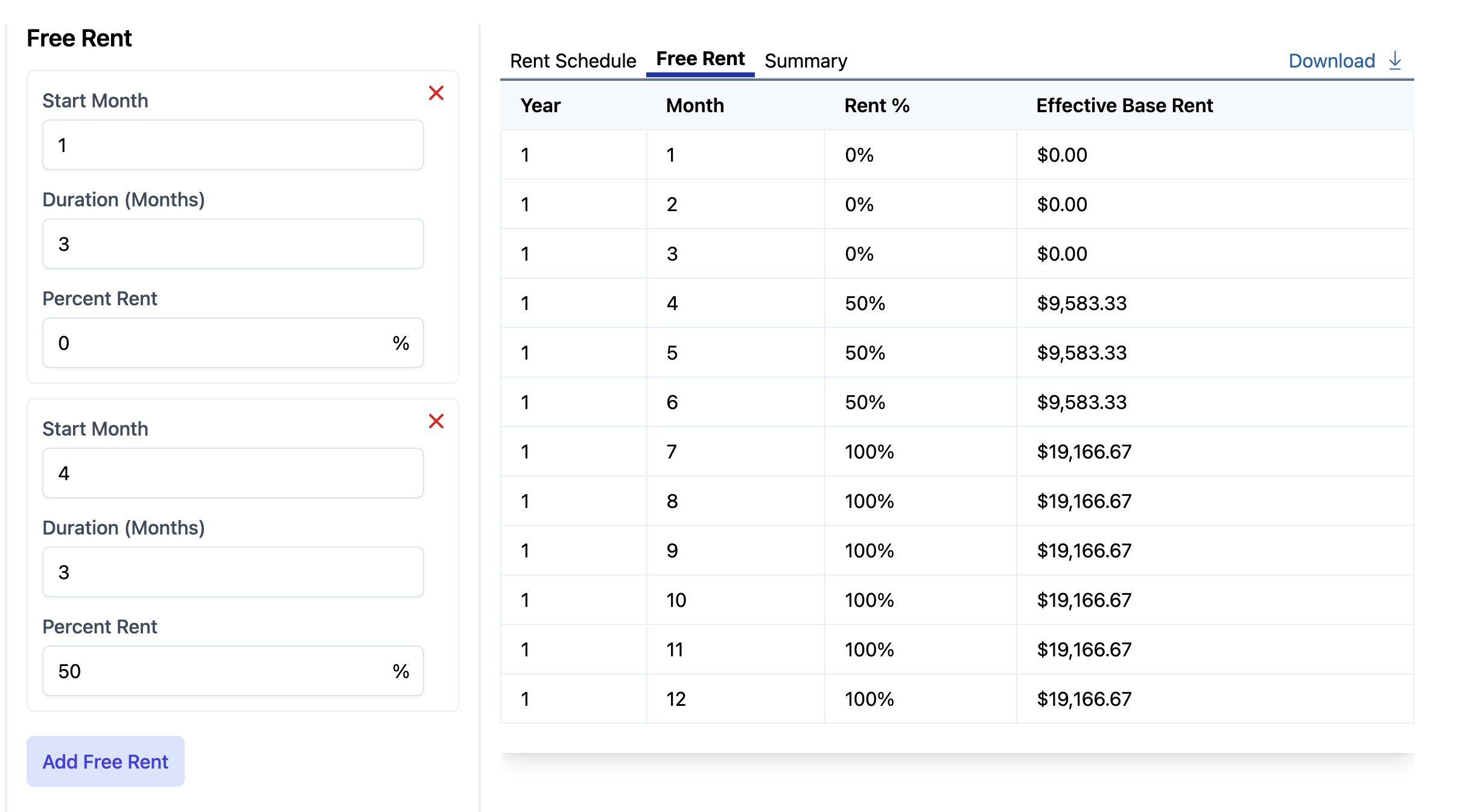

Free Rent

Any rent concessions given by the Owner. Input the start Month , duration in Months, and the percent of the rent you will pay. 0% is complete abatement, 100% is full rent. Example:

- Start Month 1, Duration 3, Percent Rent 0%

- Start Month 4, Duration 3, Percent Rent 50%

Any property expenses to be paid according to the lease. These can be flat fees, a percentage of the base rent, of a per foot charge. For example:

- Start Year 1, Amount Type: Per Foot, 3$ / SF, Frequency 1 (once a year).

Discount Rate

The implicit discount rate stated in a lease. If your company follows ASC 842 standards, you need this to calculate your total Lease Liability and Right Of Use Asset (ROU). Speak with your accountant and your attorney to discuss this if you are unsure.Tenant Improvement Allowance

Sometimes Owners will offer lease incentives for your business to lease their space. Tenant Improvement allowance is a contribution the Owner gives for the occupier to build the space to their needs. It can be paid to the tenant in cash, given as a rent credit, or cover construction costs directly. This affects your ROU.Click Calculate

The table will reload and your commercial property rent calculator results will show. Share the link with your team and they will see your inputs.

Decoding Commercial Lease Expenses: Why It's Crucial

Understanding the full scope of your commercial lease expenses is not just about knowing what you’ll pay each month. It’s about being able to plan for the future, allocate resources effectively, and avoid financial pitfalls. For example, comparing two spaces with different base rents and additional charges like taxes and insurance can dramatically impact your budget over the lease term.

A commercial lease calculator simplifies this process, breaking down complex expenses into manageable insights. This is particularly important for businesses that operate on tight margins, where every dollar counts. By having a clear understanding of your lease expenses, you can make informed decisions that align with your long-term business goals.

Creative Negotiation Strategies with a Commercial Property Rent Calculator

Armed with data from a commercial lease calculator, you can approach lease negotiations with confidence. For instance, if the calculator shows that the proposed rent increases will strain your budget, you can negotiate for a lower initial rent with higher increases later in the lease term. Or, if the landlord is reluctant to offer a large upfront concession, you might propose a "ramp-up" period where you gradually increase your rent payments over the first year.

These strategies not only make the lease more affordable in the short term but also provide flexibility for your business as it grows. A commercial lease commission calculator is also invaluable for brokers, allowing them to see how different negotiation strategies affect their commissions and ensuring they’re motivated to secure the best possible deal for their clients.

Avoiding Hidden Costs with a Commercial Lease Calculator

One of the biggest challenges in commercial leasing is avoiding hidden costs—those expenses that aren’t immediately apparent but can add up over time. You may know the commercial lease rate per foot, but it's rarely the only expense in a lease. Others might include unexpected increases in property taxes, higher-than-anticipated CAM charges, or fluctuating utility costs. By using a commercial real estate rent calculator, you can input different scenarios and see how these hidden costs might impact your overall lease expenses.

For example, if you’re considering a property in an area with volatile property tax rates, you can model different tax increases to see how they affect your budget. This proactive approach allows you to anticipate potential challenges and plan accordingly, ensuring that your lease remains affordable throughout its term.

Conclusion: Streamline Your Lease Planning with a Commercial Lease Calculator

Leasing a commercial property is a major financial decision, and accurately estimating lease expenses is crucial for the long-term success of your business. By leveraging the power of a commercial lease calculator, you can gain a clear and comprehensive view of the costs associated with leasing a commercial property. This empowers you to make informed decisions, negotiate better terms, and ensure that your lease aligns with your business’s financial goals.

Whether you’re comparing properties, budgeting for future expenses, or negotiating lease terms, a commercial lease calculator is an invaluable tool. It helps you avoid surprises, optimize financial planning, and secure a lease that supports your business's growth. Don’t let hidden costs and unexpected expenses catch you off guard. Take control of your commercial lease expenses today and position your business for sustained growth and success.

Join the newsletter to be notified when we post new content.

We value your privacy

We use cookies to ensure you get the best experience on our website. By continuing, you consent to the use of cookies.